We received the following thank-you letter from one of our happy clients.

To David Connell and all others at Federal Tax Professionals that work on my case, I would like to say thank you. you are true to your word and what you advertise on your web site. Mr. Connell you were very informative and patient with me, and that is what helped me make the decision to use Federal Tax Professionals, also your prices are far more reasonable. I will not hesitate to refer you to anybody I know, work with or meet. I put myself in a very bad situation and you saved me, I can now sleep again and so can my wife. I really can’t thank you enough. to all a Merry Christmas & a Happy New Year

Here’s a recap of how we succeeded to get our client’s salary released by the IRS:

December 15, 2008 11:50am – Richard contacted us and let us know he had a wage garnishment in effect. We immediately had our Emergency Relief Team (ERT) contact the IRS and found out Richard also had to file his 2001, 2002 and 2003 tax returns. Richard stated that he did not have the records necessary to file those taxes so the ERT ordered his income information from the IRS and sent Richard a questionnaire in order to complete his tax returns.

December 16, 2008 9:36am – Richard sent back his paperwork and we were able to prepare and email him his 2001, 2002 and 2003 tax returns for signing.

December 1, 2008 9:37am – We received his signed tax returns and the ERT contacted the IRS once again to file his taxes, negotiate a payment plan and have his IRS wage levy immediately released.

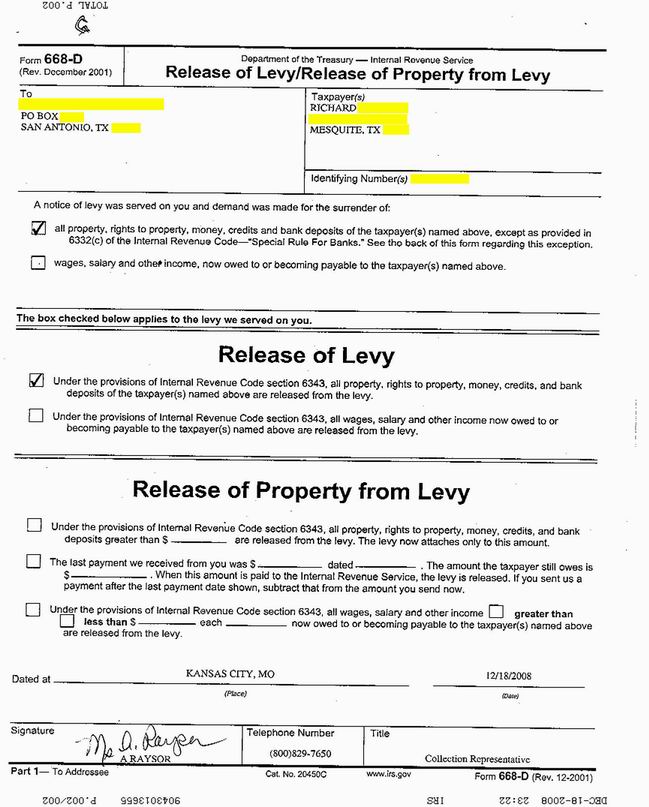

December 18, 2008 11:22pm – We received a copy of the wage garnishment release as shown below.

Within 3 business days we were able to get the IRS to release its wage levy, allowed our clients to get their salary and make this a very Merry Christmas. They now had the money they needed to buy gifts for the family.